Understanding Property Costs for Buy-to-Let Investors: Repairs vs. Improvements

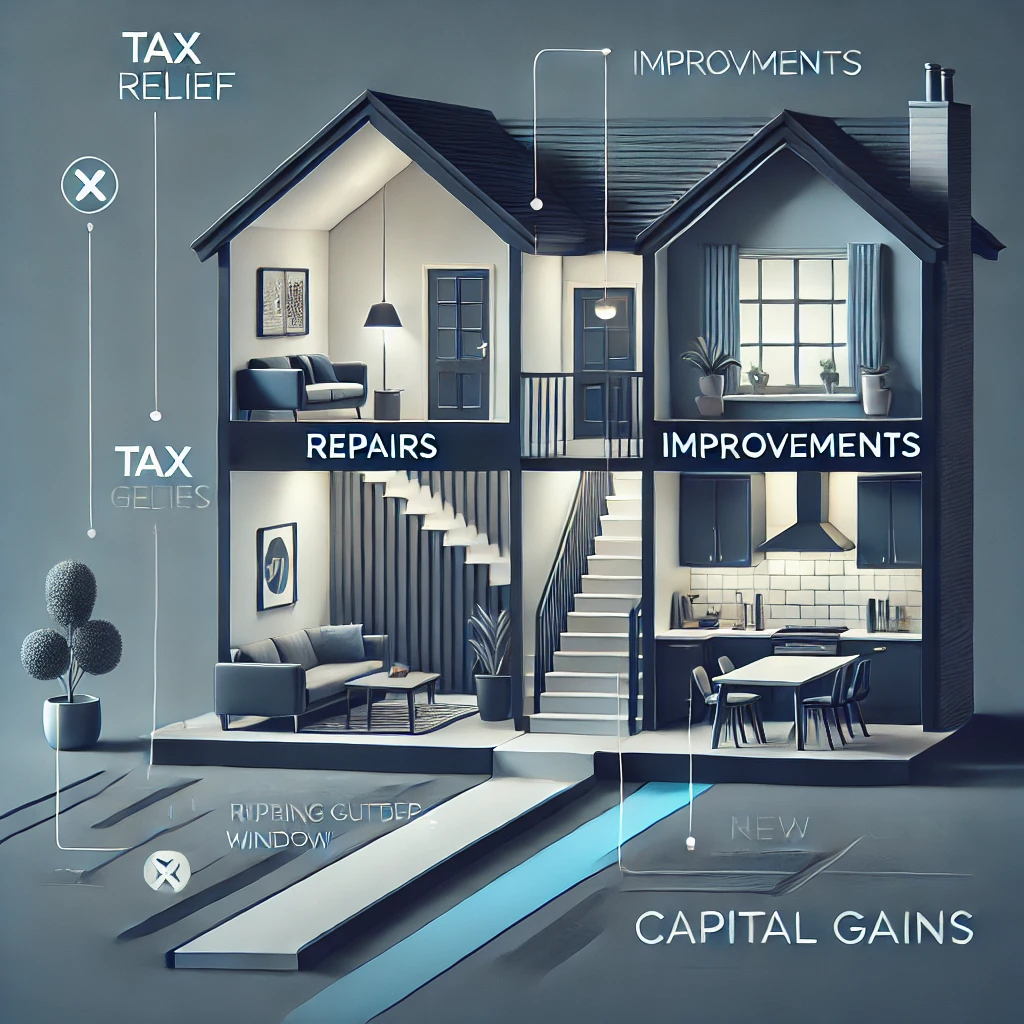

For property investors, especially those in the buy-to-let market, distinguishing between repairs (immediate tax deductions) and improvements (capital costs deductible only upon sale) is key to optimizing tax benefits. This guide explains the differences, with examples and practical guidance on handling property costs.

Capital vs. Revenue Expenditure: What’s the Difference?

- Repairs (Revenue Costs): Generally, these are expenses for maintaining or restoring a property’s existing condition. Repairs can be deducted from income in the year they occur, which provides immediate tax relief.

- Improvements (Capital Costs): These expenses increase a property’s value, functionality, or lifespan. Unlike repairs, improvements are capitalized and deducted only against capital gains when the property is sold.

Why Classification Matters

Investors typically prefer to classify expenses as repairs to lower their taxable income. However, HMRC has specific guidelines and often views substantial work as improvements. Familiarity with the rules helps ensure compliance and maximizes your tax efficiency. Capital versus revenue expenditure toolkit.

Pre-Letting Costs: What Can Be Deducted?

When purchasing a property that needs work before it’s rentable, costs for substantial renovations are generally classified as improvements. However, if you can demonstrate that the property was rentable upon purchase (e.g., with a letter from a letting agent), some work may qualify as repairs. Here’s a summary of how HMRC treats pre-letting costs:

- Repairs: Costs to maintain a property in its existing rentable condition can be claimed as revenue expenses.

- Improvements: Renovations required to make the property initially rentable are considered capital costs.

For more information, see HMRC’s guidance on repairs.

What Qualifies as a Repair?

According to HMRC, a repair is generally defined as replacing part of the property with the nearest modern equivalent. This could include replacing single-glazed windows with double glazing, swapping out lead pipes for copper, or switching wooden beams with steel girders. Repairs restore a property to its original state without enhancing its value.

Examples of Allowable Repairs

- Windows: Replacing single glazing with double glazing.

- Guttering: Installing modern guttering.

- Piping: Replacing lead pipes with modern materials.

For more detailed guidance, refer to HMRC’s Specific deductions.

Kitchens and Integral Features

Basic kitchen replacements, such as cabinets and worktops, can qualify as repairs if they’re of a similar standard. However, adding additional storage or high-end appliances would likely be considered a capital improvement.

Integral Features: Special rules apply to specific parts of a property, such as electrical systems, heating, or water systems. If replacement costs exceed 50% of the system’s original value, the expenditure is considered capital.

Replacement of Domestic Items (RDI) Relief

Since 2016, the Replacement of Domestic Items Relief (RDI) has replaced the Wear and Tear Allowance, covering costs for replacing items like furniture, appliances, and furnishings. Key requirements for claiming RDI:

- The item replaced must no longer be usable by tenants.

- The replacement should be of similar quality to the original.

Eligible items include:

- Moveable furniture (e.g., beds, wardrobes)

- Furnishings (e.g., carpets, curtains)

- Household appliances (e.g., fridges, washing machines)

For a complete breakdown, see HMRC’s guidance on Replacement of Domestic Items Relief.

Improvements vs. Repairs: A Practical Approach

An improvement changes the property’s functionality, value, or lifespan. Major renovations, layout changes, or enhancements are considered capital expenses. Small updates that replace older materials with equivalent modern ones, however, can still be considered repairs.

For more information, see HMRC’s Property Income Manual PIM2030.

Case Studies: Practical Examples

Case Study 1: John’s New Buy-to-Let Property

John purchased a buy-to-let property that required work before it could be rented. The property needed repairs to windows and new carpeting, but was otherwise in reasonable condition. John received a letter from a letting agent confirming it was rentable.

- Repairs: John replaced single-glazed windows with double-glazing and replaced worn carpeting, both considered revenue expenses.

- Outcome: John claimed these as deductible repairs, as the property was in a rentable condition upon purchase.

Case Study 2: Sarah’s Kitchen Upgrade

Sarah owns a rental property where the kitchen units were outdated. She decided to replace the old units, install new countertops, and add extra cabinetry.

- Repairs: Sarah’s replacement of the old units and countertops qualified as repairs, as she used similar materials.

- Improvement: Adding additional cabinetry was treated as a capital improvement, as it enhanced the kitchen’s capacity.

- Outcome: Sarah deducted the replacement costs as repairs but classified the extra cabinetry as a capital expense, aligning with HMRC’s guidelines.

Case Study 3: Tom’s Heating System Replacement

Tom owns a buy-to-let property with an aging central heating system that frequently breaks down. To avoid ongoing repairs, he decides to replace the entire system, including radiators and piping.

- Integral Feature: A heating system is classified as an integral feature under HMRC rules. Since Tom is replacing more than 50% of the system, the entire cost is treated as a capital expense.

- Outcome: Tom cannot deduct the cost of the new heating system from his rental income immediately. Instead, he records it as a capital improvement, which will offset future capital gains when he eventually sells the property.

This example illustrates that replacing substantial parts of integral features, like heating, water systems, or electrical systems, often results in capital treatment. For further guidance on integral features, see HMRC’s integral features guidance.

Retirement Calculators

Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Pellentesque in ipsum id orci porta dapibus. Pellentesque in ipsum id orci porta dapibus. Proin eget tortor risu

Why We Use Cloud Accounting and How It Supports HMRC’s “Making Tax Digital” Extended Strategy

What is Making Tax Digital (MTD)?

Making Tax Digital (MTD) is a key part of the UK government’s strategy to modernize the tax system. It aims to make the process of managing taxes more effective, efficient, and easier for taxpayers by requiring businesses to keep digital records and submit tax returns online using compatible software.